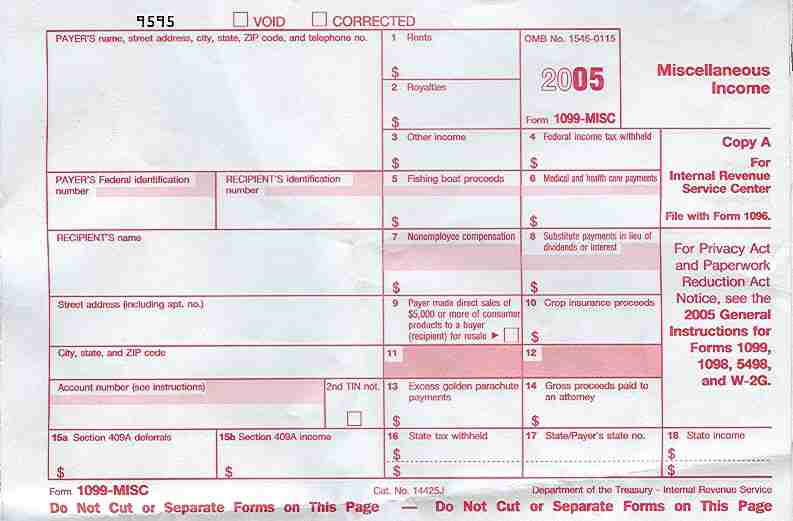

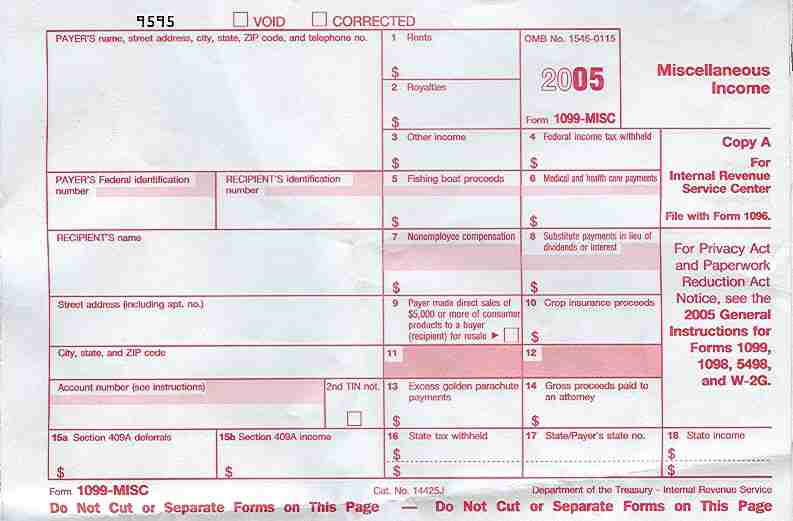

IRS 1099-MISC form

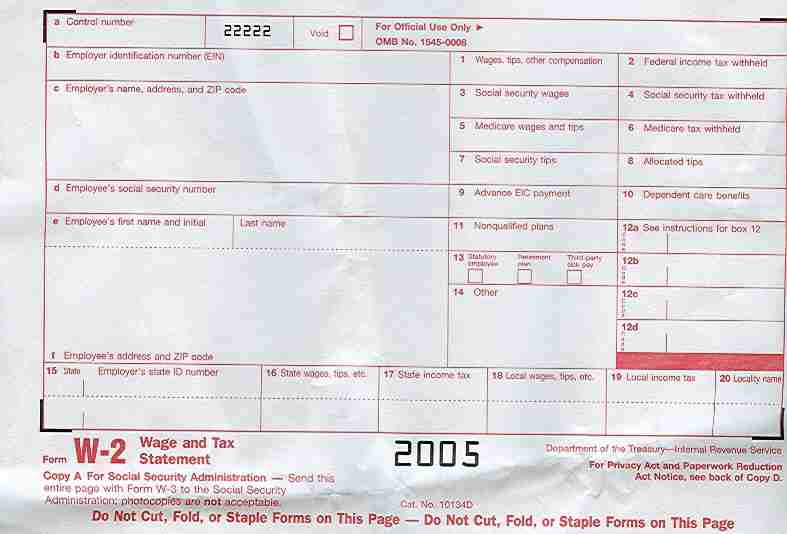

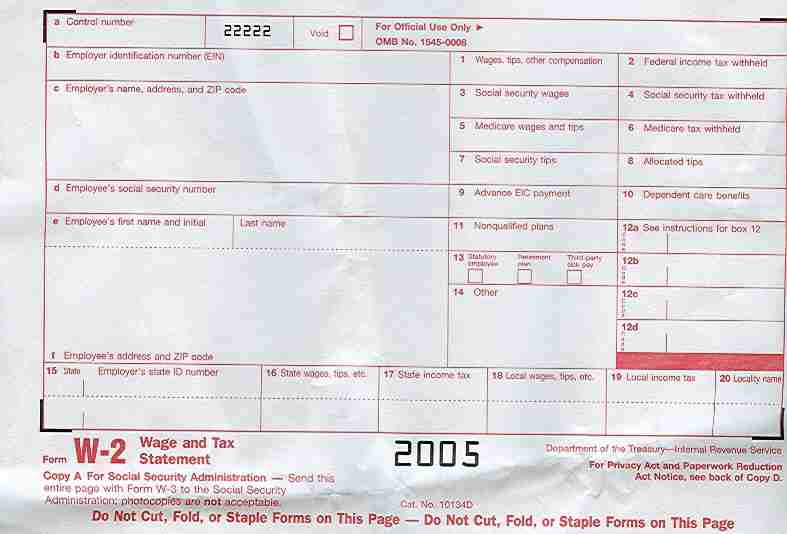

IRS W-2 form

|

W-2 and 1099-MISC Tax Forms

Other uses for W-2 and 1099 forms. Don’t throw those W-2 and 1099 forms away after paying your taxes. They have other uses. Many times instead of forcing to you go thru a credit check a business will accept a W-2 form or 1099 form as proof of your income. Some businesses will even let you use them in place of a photo identification card. Although I don’t have any ID the last apartment complex I rented at allowed me to use a W-2 form instead of a credit check or ID. As most people know a W-2 form is sent to you buy your employer with the amount of income you made and the amount of taxes deducted from your wages. At the beginning of 2006 your employer will send you your W-2 forms for the work you did in 2005. A 1099 form or more specifically a 1099-MISC form is given to you when you have worked for a business as a contractor or subcontractor and they have paid you for your work but not taken out any taxes. The IRS publication “2005 General instructions for form 1099, 1998, 5498, andon page 16 says that a 1099-MISC form is for “Payments for services performed for a trade or business by people not treated as its employees. Examples: fees to subcontractors or directors”Like a W-2 form you will get your 1099-MISC form for the work you did in the year 2005 at the beginning of 2006. Normally your employer will mail you your W-2 or 1099-MISC form at the beginning of the year. But there are a number of ways to get blank W-2 or 1099 forms. Near the end of each year OfficeMax, Staples, BizMart and office supply store will start selling W-2 and 1099 forms. You can buy a pack of 20 W-2 or 1099-MISC forms for $5. Why waste money at the BizMart when Uncle Sam will give you as many 1099-MISC or W-2 forms that you want for free. Just dial and tell them you would like the IRS to mail you 50 W-2 or !099-MISC forms. Be specific and tell they what type you want. The IRS has single sheet forms that can be run thru laser printers or multi-sheet forms that can be run thru impact printers. Delivery takes 10 days by U.S. mail but best of all the service is free. But why waste time waiting for the IRS to mail you W-2 or 1099-MISC forms when you can print them out on your printer. Go to this IRS web site and you can get any W-2 or 1099 form printed for at least the last 10 years: http://www.irs.gov/formspubs/index.htmlW-2 Forms are pretty simple. There is only one version of a W-2 form that I know of. 1099 forms get rather messy. There are about 20 different types of 1099 forms. The 1099 form used to report income is the 1099-MISC form. Click on the item labeled: Form and Instruction numberAnd when it shows you the next web page it will display a number of W-2 and 1099 forms that have been used for at least the last 10 years. Click on the form you want, and it will bring up a PDF or postscript form of the document that can be printed on your local printer.

|